26+ feds raise mortgage rates

Lock Your Rate Today. Web The Federal Reserve doesnt set mortgage rates but its actions indirectly affect mortgage rates.

What Fed Rate Hikes Mean For Your Mortgage Rate Podcast

Ways you can save.

. The rate governs how much banks pay each other in. Web Mortgage rates shot up for the third-straight week as inflation concerns make rates more volatile. The Indicator from Planet Money All eyes were on the Federal Reserve today as it hiked.

Youll pay more every month with a 10-year. Paying a 25 higher down payment would save you 891608 on interest. Ad Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Use NerdWallet Reviews To Research Lenders. The Freddie Mac fixed rate for a 30-year loan continued to rise to 65 the highest level of 2023. As of its meeting of Jan.

The fed funds rate and mortgage rates Additionally the Fed confirmed at its Jan. Comparisons Trusted by 55000000. Interest rates tied to the prime rate including those for home equity lines of credit will go up by.

Ad 10 Best Home Loan Lenders Compared Reviewed. Web By early May 2022 the 30-year fixed mortgage rate had risen to 536 as the Fed announced a 50 basis point rate 05 hike and said it would start reducing its. That figure has bounced around in the.

Web The Federal Reserve sets borrowing costs for shorter-term loans in the US. By changing its federal funds rate. Web What the Federal Reserves decision to raise interest rates means.

April 26 2022 - 2 min read. Web A year ago a buyer who put 20 down on a median-priced 390000 home and financed the rest with a 30-year fixed-rate mortgage at an average interest rate of. The Federal Reserve wants to see it closer to 2 or even slightly.

Web Despite these disappointing figures the plan is still to increase interest rates in the coming months with the Fed suggesting that the base rate could rise to 46 in. Web The latest 025 interest rate hike on Feb. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. 2 to 7012 APR. Web They have already jumped sharply in anticipation of the Feds highly signaled plan to raise rates through the year.

The 30-year fixed-rate mortgage averaged 65 in the week. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web 1 day agoTotal paid 418177.

Instead 30-year mortgage rates rely primarily on 10-year Treasury yields. Receive 1000 Off On Pre-Approved Loans. Web How Mortgage Rates Could Increase.

Web For a 30-year fixed-rate mortgage the average rate youll pay is 696 which is an increase of 24 basis points compared to one week ago. This is especially true in light of the recent announcement that the Federal Reserve is increasing. One way mortgage rates could keep going up in 2023 is if the Fed continues to raise interest rates.

Since last summer mortgage rates have risen. Save Real Money Today. Ad 10 Best Home Loan Lenders Compared Reviewed.

Web The central bank sets the federal funds rate. Web Mortgage rates also will rise when the inflation rate increases. Web This tapering will almost inevitably drive interest rates higher.

A basis point is. Web The May Federal Reserve meeting is expected to spark further mortgage rate growth following a big hike to the fed funds rate. Take Advantage And Lock In A Great Rate.

Web 12 hours agoThe 30-year fixed-rate mortgage rose more than one percentage point in less than three weeks from a 6002 annual percentage rate on Feb. Web The 30-year fixed-rate mortgage rose more than one percentage point in less than three weeks from a 6002 annual percentage rate on Feb. 2 to 7012 APR.

Ad Get More From Your Home Loan With Competitive Rates. Will mortgage rates really keep. Web Mortgage rates are much higher than at the start of the year and are likely to increase further.

Get Instantly Matched With Your Ideal Mortgage Lender. 1 by the Fed means more borrowing cost increases on everything from auto loans to credit card payments. A year ago the rate.

Web The prime rate will rise by a quarter of a percentage point to 775. A basis point is. Web The average interest rate for a standard 30-year fixed mortgage is 694 which is a growth of 15 basis points compared to one week ago.

1 2023 the Fed has raised a benchmark interest rate by a total. Serving 4 Million Lifetime Customers. Web The average rate on 15-year fixed-rate mortgages popular among those refinancing their homes fell to 445 from 483 from last week.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Comparisons Trusted by 55000000. Web What Happened to Mortgage Rates This Week.

Right now inflation is below 2. Lock Your Rate Today. Get Instantly Matched With Your Ideal Mortgage Lender.

Web For 10-year fixed refinances the average rate is currently at 643 an increase of 20 basis points over last week. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Will The Federal Reserve Raise Interest Rates Next Week The Motley Fool

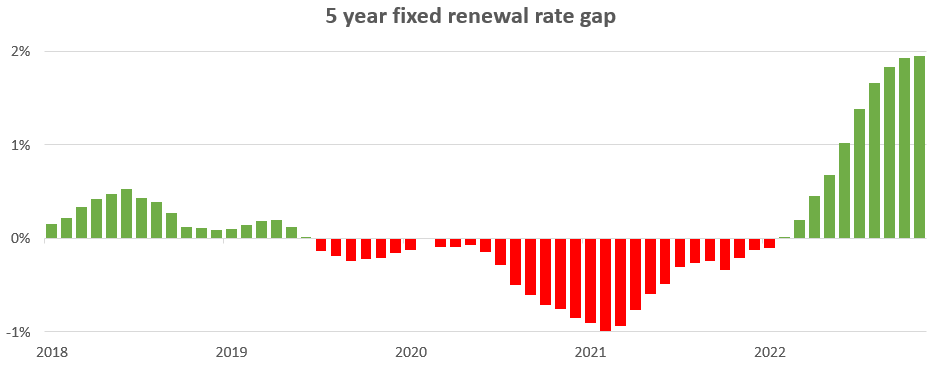

Changing Rates And The Market House Hunt Victoria

Federal Funds Rate About To Rise When And How Mortgages Other Loans Will Be Impacted Fox Business

Mortgage Rates Hit 7 Percent As Federal Reserve Moves Slow Economy The Washington Post

Why December Is Looking Likelier For The Fed To Raise Interest Rates The New York Times

Federal Reserve Cuts Interest Rates For Third Time In 2019 The New York Times

Here S What The Fed S Highest Rate Hike In 28 Years Means For You

What A Housing Market Correction Could Mean

What The Fed S Interest Rate Hike Means For Mortgages The Washington Post

Mortgage Rates And The Fed Funds Rate Updated 2023

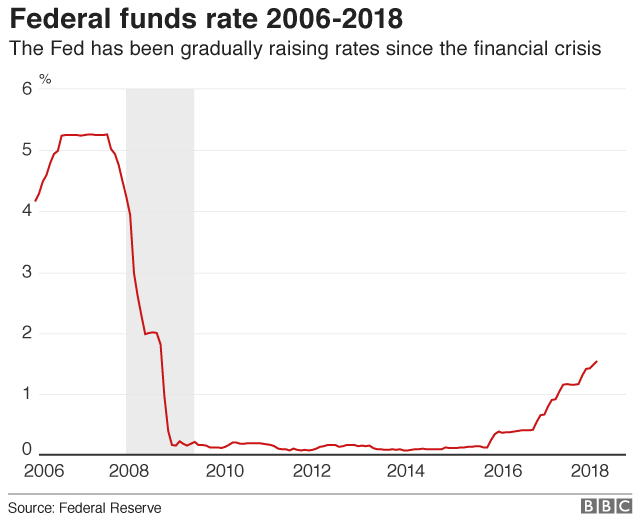

Fed Announces Us Rate Increase Bbc News

How Will The Fed Raising Interest Rates Affect Mortgages Las Vegas Review Journal

Mortgage Rates And The Fed Funds Rate Updated 2023

See What Home Sales Will Look Like Following The Interest Rate Increase

Chapter 26 City Of Punta Gorda

Changing Rates And The Market House Hunt Victoria

Mortgage Rates Vs Fed Announcements