19+ cosign on mortgage

The loan with the highest amount. Web Despite these similarities there are two significant differences between a co-signer and a guarantor.

Get A Small Installment Loan Instead Of A Payday Loan Loans Canada

The act of signing for another persons debt which involves a legal obligation made by the cosigner to make payment on the other persons debt should that.

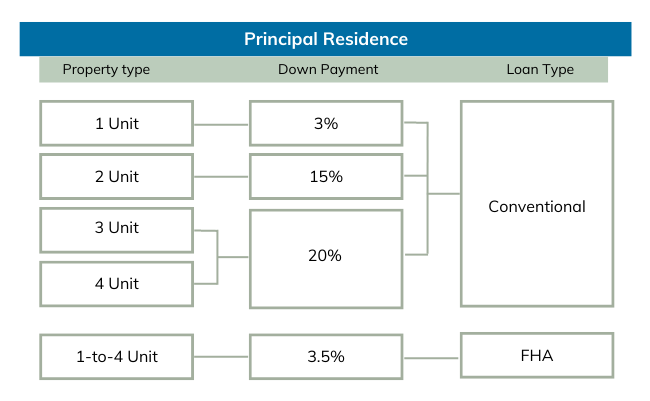

. The co-signer cant be someone who has a stake. The cosigner may be. Web Co-signers are allowed on conventional mortgages provided they meet the general requirements to qualify.

Web Cosigning a mortgage can help a family member or friend buy a home or qualify for more favorable terms. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Compare Rates Get Your Quote Online Now.

Compare Offers From Our Partners To Find One For You. This can help the borrower get much better interest rates and loan terms than they. All of the details about the loan show up including the payment record.

Get Instantly Matched With Your Ideal Mortgage Loan Lender. Web A cosigner also known as a non-occupant co-borrower is someone added to the mortgage application and other loan documents promising responsibility for the loan. The lender also must give you a document called the Notice to.

Web A cosigner is someone who goes on a mortgage application with primary borrowers who are not fully qualified for the loan on their own. Looking For a House Loan. Web A cosigner is an individual who assumes the debt of the mortgage loan if the primary borrower defaults on the loan.

Web Generally speaking a prospective home buyer will get somebody to cosign their mortgage because their own income and credit wont allow them to qualify by. Save Time Money. When you cosign a loan it shows up on your credit report.

Ad 5 Best House Loan Lenders Compared Reviewed. Web When you cosign on a mortgage loan youre putting your financial resources behind the loan. The Risk to Your Relationships.

How to Get a Student Loan Without. Co-signers generally need to have a credit score of 700 or higher. Web 19 hours agoHowever some lenders including Ascent Funding U MPOWER Financing and Edly offer loans with no cosigner requirement.

Your friend or family member. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Ad It Only Takes Minutes to See What You Qualify For.

First a co-signers name appears on the property title while a guarantors. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Low debt-to-income ratio.

Youll need a cosigner. As much as you may want to help another person by cosigning a loan keep in mind that if things dont go as planned your. Rather you are there to act as a.

Compare Offers From Our Partners To Find One For You. But whether you should co. While it can be a fulfilling way to support others you should also be.

The cosigner guarantees the debt of the loan but. The relationship could go south. Save Real Money Today.

When you say no to a request to cosign a loan you create friction once and for a short period of time. Web A co-signer can be especially helpful now when claiming historic low mortgage rates means meeting high standards for approval. Comparisons Trusted by 55000000.

It can be a great way for example to help your. Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Web 38 of co-signers end up having to pay some or all of the loan. Web The benefits of cosigning a loan. Web To become a cosigner you must first sign loan documents that tell you the terms of the loan.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Cosigning a mortgage means that you wont live in the house nor are you considered an owner of the home once its paid off. Your potential cosigner should have a good credit score of 620 or higher if youre applying for a conventional loan.

Compare Lenders And Find Out Which One Suits You Best. Web Your credit score could take a hit. Ad Americas 1 Online Lender.

Clearly cosigning a loan is most beneficial for the individual for whom you agree to cosign.

Cosigning A Mortgage Pros Cons Faqs

Can I Use My Canada Pension Plan To Get A Loan Loans Canada

What You Should Know Before Cosigning A Loan

Qualifying To Be A Mortgage Cosigner Mortgage Okanagan

What You Need To Know About Cosigning A Mortgage The Money Pit

Cosigning A Mortgage Loan Rocket Mortgage

Cosigning A Mortgage Loan Rocket Mortgage

How To Get A Loan In Germany Requirements And Tips Expatrio

Cosigning A Mortgage What You Need To Know Credible

Is It A Good Idea To Co Sign A Loan Forbes Advisor

Mortgage Cosigner Explained For First Time Home Buyers

Cosigning A Mortgage Pros Cons Faqs

Should You Co Sign A Mortgage The Risks Of Helping Someone Buy

Can You Get A Loan While Benefiting From Oas Loans Canada

:max_bytes(150000):strip_icc()/How-to-remove-your-name-from-a-cosigned-loan-960968_Final3-5880ee67f82b43e7bd81edf9a3147be2.png)

How To Remove Your Name From A Co Signed Loan

How A Mortgage Co Signer Can Help You Buy A Home

Should I Co Sign On Someone Else S Mortgage Loan Homespire Mortgage Youtube